us exit tax percentage

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. Frequent Flyer Tax 2 750.

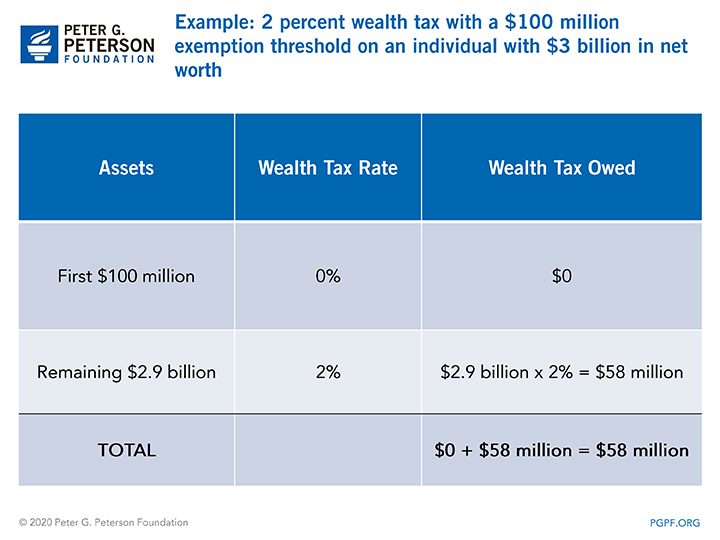

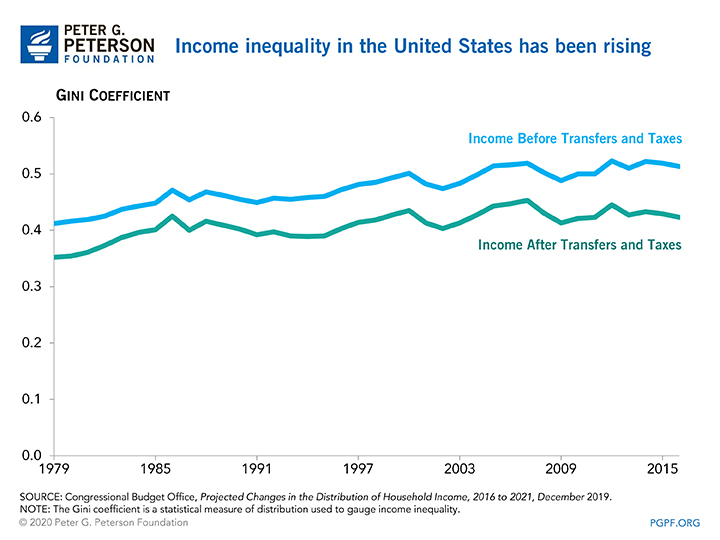

What Is A Wealth Tax And Should The United States Have One

Green Card Exit Tax 8 Years Tax Implications at Surrender.

. Your average net income tax liability from the past five years is over. For eligible plans US expatriates may be subject to a 30 US tax rate on all taxable payments which is to be deducted and withheld by the payor. The Exit Tax Planning rules in the United States are complex.

The term expatriate means 1 any US. Green Card Exit Tax 8 Years. International Departure Tax 3.

If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is. Flight Segment Tax 1a domestic 450. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their.

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. What is the US exit tax rate. Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual.

The IRS Green Card Exit Tax 8 Years rules involving US. Legal Permanent Residents is complex. IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US.

The covered expatriate rules apply to US. Citizens or Legal Permanent Residents who qualify as an LTR Long-Term Residents. In special cases individuals may.

Persons who were either US. Citizenship or long-term residency. Passenger Ticket Tax 1 domestic 800.

6 NovemberDecember 2020 Pg 60 Gary Forster and J. Expatriation from the United States. Citizen who relinquishes his or her citizenship and 2 any long - term resident of the United States who ceases to be a lawful.

The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly It is paid to the IRS as a part of. What is expatriation tax.

The Basics of Expatriation Tax Planning. Citizens who have renounced their. Exit taxes can be imposed on individuals who relocate.

The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value.

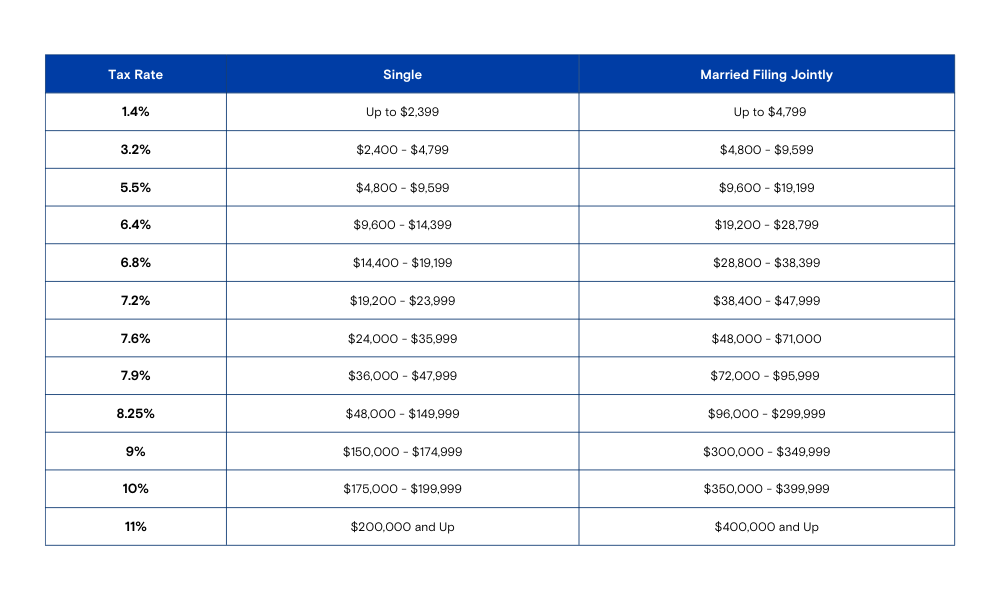

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

Renouncing Us Citizenship Expat Tax Professionals

Exit Tax Us After Renouncing Citizenship Americans Overseas

What Is A Wealth Tax And Should The United States Have One

What Are The Us Exit Tax Requirements New 2022

How Not To Pay Taxes Four Legal Ways To Not Pay Us Income Tax

Export Tax Incentives The Effect Of Potentially Rising Tax Rates Journal Of Accountancy

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

California S Exit Tax Explained

Budgetary And Economic Effects Of Senator Elizabeth Warren S Wealth Tax Legislation Penn Wharton Budget Model

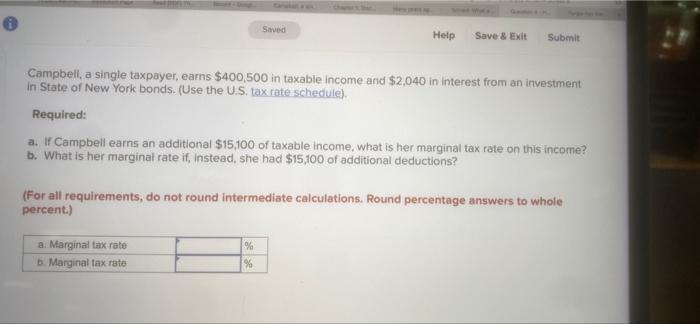

Solved Saved Help Save Exit Submit Campbell A Single Chegg Com

Cross Border M As Post Tcja Three Things Advisers Should Know

Democrats Want To Tax The Very Rich Here S Who They Are Cnn Politics

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

The U S Exit Tax Expatriation Tax What It Means For Your Income

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Apple S Tax Strategy Aims At Low Tax States And Nations The New York Times

Expatriation Critical Financial Planning And Tax Considerations For U S Citizens And Green Card Holders